UAE Federal higher education institutions create history with mobile learning launch The official launch marked the largest nationwide mobilization of mobile learning in higher education anywhere in the world; implementing the 3rd generation iPads . READ MORE Please connect with me if you are using mlearning.

Tag: #highered

Yes, Hybrid Online Learning Delivers

Hybrid Online Learning Delivers From the Bacon’s Rebellion web site (a great site you should check out!) is a blog post supporting University of Virginia’s move to join Coursera, using the latest research from Ithaka S+R: Interactive Learning Online at Public Universities: Evidence from Randomized Trials. As the University of Virginia has been embroiled in a battle over…

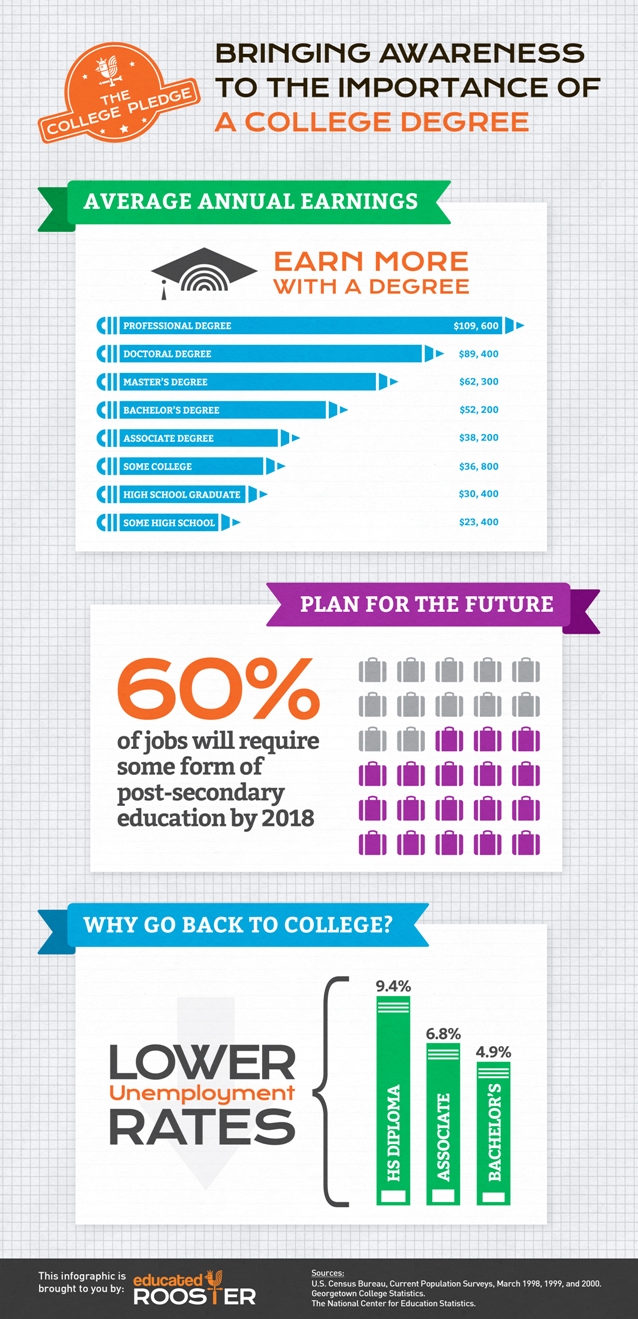

10 Reasons For Going Back To College

Tell me one good job you can get without a college degree? Such was the question posed to me by a recruiter from one of our state colleges. I was eager to argue that many entrepreneurs, programmers, and other service industries did not require college degrees but, agreed that current competitive trends made college–or an…

College Grads: The New Debt Slaves

Despite growing evidence of unemployed college graduates, under-employed college graduates (working a job that doesn’t require an advanced degree), and over a TRILLION dollars in College Debt, it concerns me that a “4-year College Education” is still being sold to high school students as their ONLY hope for success after graduation. Are students being sold…

Future of Higher Education Becomes Unclear As Free Online Courses Multiply

Future of Higher Education Becomes Unclear As Free Online Courses Multiply A quick interview by the New York Times with Daphne Koller and Andrew Ng of Stanford–makers of the COURSERA platform–are adding 12 universities to the online education venture they founded. Source How could free massive open online courses, or MOOCs, benefit or be detrimental to…

How College Students Use SmartPhones [INFOGRAPHIC]

There can be no denying teenage reliance on their portable devices and Online Degrees.org provides a nice infographic on how college students are using their smartphones. The dominant activity appears to be communication, although no data is presented on social media use. If “idle time” is dominanted by smartphone use, is it still idle time? I’ve…