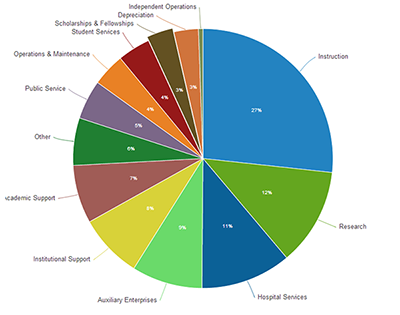

The tuition at our nation’s colleges are rising faster than inflation, medical costs, and importantly: the income of 99% of Americans. Four years at a private university now costs as much as a new Ferrari sports car, and a student from a public university can expect to graduate with $25,000 or more in student debt….

Category: Higher Education

Higher Education

50 BILLION PROFIT Off Of Students

College Debt Crisis “…the most profitable in the country” I’ve written extensively about the high-cost of a 4-year college and whether high school educators are doing a DISservice to students in pushing them to a 4-year college– at any cost. It’s NOT like it was in the old days when students could go to school…

Choosing the Right #HigherEd Degree (#Infographic)

Source: http://www.gradschoolhub.com/choosing/ Choosing the Right Degree What matters most when choosing a graduate degree? Money? Doing something you love? The journey to finding the right master’s degree can be a long one. What Do You Want? – Consider these options when choosing a graduate school: Location Quality of life Degree programs offered Cost Time Resources…

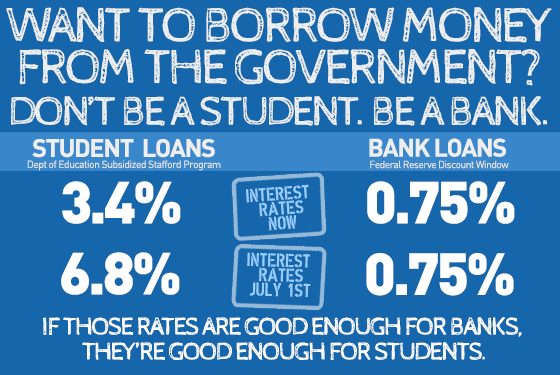

Bank On Student Loan Fairness Act

On JULY 1st, 2013, the interest rate on new Federally subsidized Student Loans will DOUBLE from 3.4% to 6.8% The Federal Government currently makes 36 cents in PROFIT from every dollar they loan a student for education. Bank On Student Loan Fairness Act I’ve written extensively on the dangers and my concern for the over…

Student Loan Debt by the Numbers

12 Disturbing Facts about the over a TRILLION Dollars in Student Loan Debt. Is this the next financial crisis as tuition is up nearly 500% in the past decade? Student Loan Debt by the Numbers $1.1 TRILLION : Approximate amount of outstanding student loan debt—second only to mortgages in household debt. 60% of the $1 Trillion…

New Game Changer for Higher Education: Minerva Project

I remember many years ago, the Arizona State University complained about students enrolling in their college but never going to class because they’d stay in their dorm rooms and take online courses. At the time, ASU had to reflect on whether this was something that was good or not. Fast forward several years later and…