Daphne Koller: What We’re Learning From Online Education Daphne Koller is the ‘birth mother’ of Coursera, and along with Stanford colleague Andrew Ng are the two behind the rise of MOOC’s and disruptive elearning in higher education. This is a FANTASTIC video which provides insight into the impetus for Coursera and an inside view of…

Category: Educational Change

Yes, Hybrid Online Learning Delivers

Hybrid Online Learning Delivers From the Bacon’s Rebellion web site (a great site you should check out!) is a blog post supporting University of Virginia’s move to join Coursera, using the latest research from Ithaka S+R: Interactive Learning Online at Public Universities: Evidence from Randomized Trials. As the University of Virginia has been embroiled in a battle over…

Interactive Learning Online at Public Universities (Research)

Interactive Learning Online at Public Universities: Evidence from Randomized Trials “Strategic” Educational Consultants Ithaka S+R released their latest research report (download below) on Interactive Online Learning. They summarized: Online learning is quickly gaining in importance in U.S. higher education, but little rigorous evidence exists as to its effect on student learning outcomes. In “Interactive Learning Online…

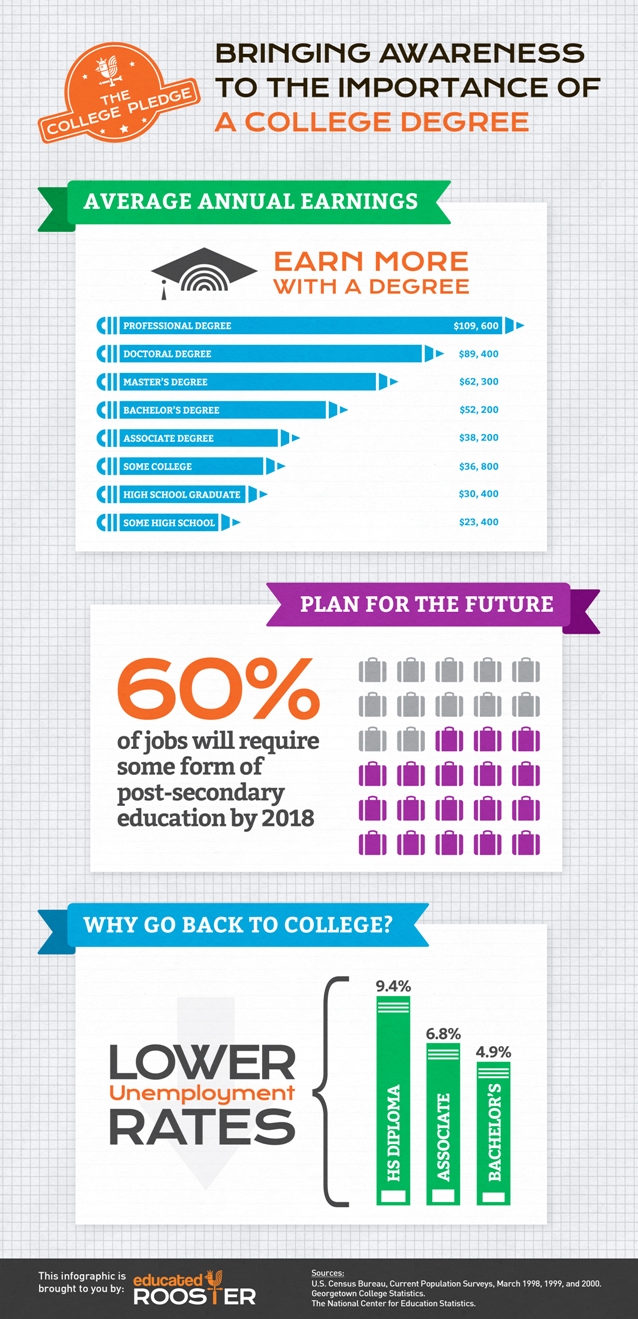

10 Reasons For Going Back To College

Tell me one good job you can get without a college degree? Such was the question posed to me by a recruiter from one of our state colleges. I was eager to argue that many entrepreneurs, programmers, and other service industries did not require college degrees but, agreed that current competitive trends made college–or an…

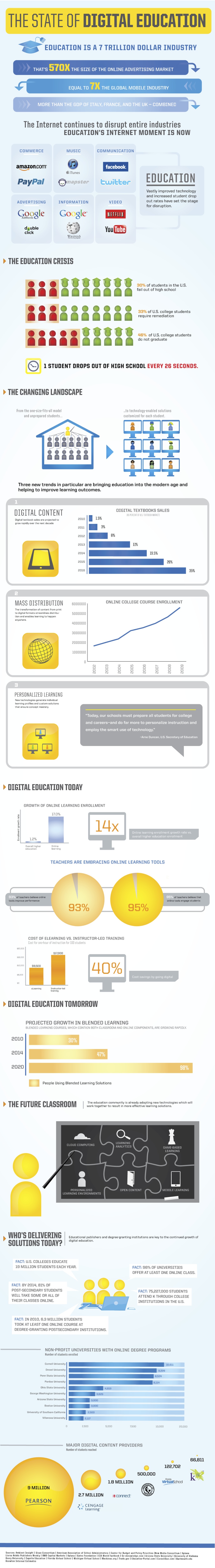

Education Is A 7 TRILLION Dollar Industry [INFOGRAPHIC]

Education is a 7 TRILLION Dollar Industry

Colleges Suing Their Own Students For Repayment

Colleges Suing Their Own Students For Repayment What happens when some of the most prestigious college graduates can’t get jobs to repay their loans… Yale Suing Former Students Shows Crisis in Loans to Poor Needy U.S. borrowers are defaulting on almost $1 billion in federal student loans earmarked for the poor, leaving schools such as Yale…