12 Disturbing Facts about the over a TRILLION Dollars in Student Loan Debt. Is this the next financial crisis as tuition is up nearly 500% in the past decade? Student Loan Debt by the Numbers $1.1 TRILLION : Approximate amount of outstanding student loan debt—second only to mortgages in household debt. 60% of the $1 Trillion…

Search Results for: debt

College Grads: The New Debt Slaves

Despite growing evidence of unemployed college graduates, under-employed college graduates (working a job that doesn’t require an advanced degree), and over a TRILLION dollars in College Debt, it concerns me that a “4-year College Education” is still being sold to high school students as their ONLY hope for success after graduation. Are students being sold…

Beyond STEM: Educating a Workforce of Thinkers and Doers Takes Liberal Arts

From where I sit, it feels like the study of the liberal arts and the culmination of that education—the liberal arts and sciences degrees—are being challenged like never before. State governors, top business executives, and parents are questioning the end products that come from liberal arts institutions. In a recent Washington Post article, a managing…

#EdTech #HigherEd Interview: Kevin Corbett on Higher Ed’s Online Future

One of EdTech’s 50 must-read IT bloggers speaks out on the issues in higher education that are shaping the future. by D. Frank Smith Google+Twitter Frank is a social media journalist for the CDW family of technology magazine websites. Kevin Corbett is an online learning program developer with a keen interest in social media, gamification and mobile learning….

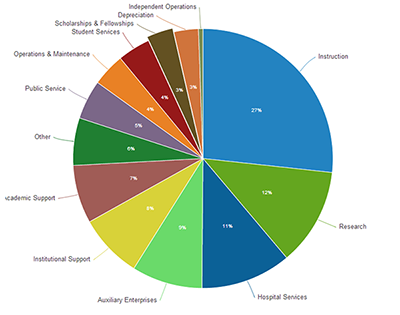

Where Does All The Money For #HigherEd Tuition Go?

The tuition at our nation’s colleges are rising faster than inflation, medical costs, and importantly: the income of 99% of Americans. Four years at a private university now costs as much as a new Ferrari sports car, and a student from a public university can expect to graduate with $25,000 or more in student debt….

50 BILLION PROFIT Off Of Students

College Debt Crisis “…the most profitable in the country” I’ve written extensively about the high-cost of a 4-year college and whether high school educators are doing a DISservice to students in pushing them to a 4-year college– at any cost. It’s NOT like it was in the old days when students could go to school…